Not everyone has the same goals when it comes to retirement. Some people might want to travel the world or live abroad, while others will seek to downsize their home and spend more time with family or grandchildren. Retirement planning isn’t a one-size-fits-all process, so financial advisors focus on developing an individual plan for each client with achievable milestones. A good advisor can push your plan into motion while also remaining realistic about savings goals and investment returns.

But while no two retirement plans are the same, the setbacks people endure all seem to stem from the same mistakes. And when it comes to personal finance, you don’t need to be a genius investor or earn a seven-figure income. Sometimes avoiding big mistakes is all you need to do to achieve your financial goals. Here are five of the most common mistakes prospective retirees make and how to avoid them yourself.

1) Failing to Plan Early

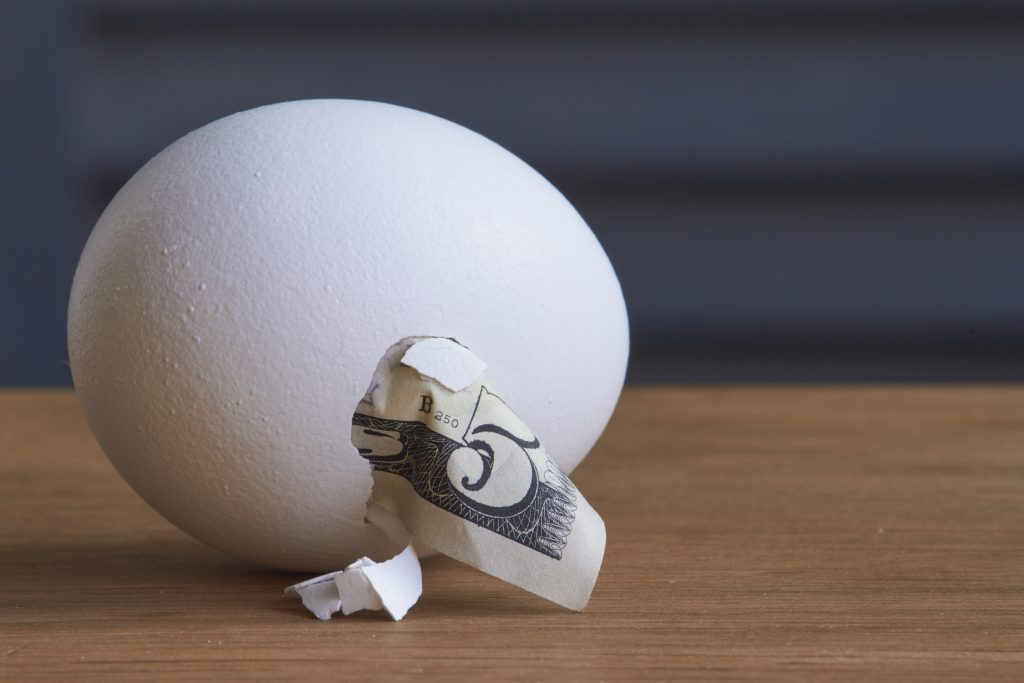

The best time to invest for retirement is when retirement couldn’t be further from your mind. Planning for retirement might seem excessive and pointless when you’re in your early 20s, but it’s the best time to put a savings plan in motion and begin building a nest egg.

The earlier you start saving for retirement, the more flexibility you’ll have with savings rates and investment composition. Plus, you’ll be better positioned to recover from a serious mistake, like taking on too much risk with a single company or buying overpriced mutual funds.

Compound interest is one of the most powerful forces on Earth (Albert Einstein may have said this, but there’s never been any true confirmation). By building up savings early, you allow compound interest to work in your favor not just over years, but multiple decades. When your time horizon expands into multiple decades, there’s no need to fear market downturns or recessions.

You just keep funding your accounts and let the chips fall as they may. And if you haven’t begun savings? There’s no such thing as being too late. The best time to save for retirement may have been 20-30 years ago, but the second-best time is today.

2) Ignoring Tax-Sheltered Accounts

Saving for retirement is crucial, but where you put your savings is just as important as how much you save. Keeping your nest egg in a taxable brokerage account or savings account may give you unlimited access to it, but you won’t get any breaks when the government comes calling for its cut. Thankfully, the government offers some pretty generous tax breaks if you save your retirement funds in the proper vehicles – and keep your hands off them until you reach a certain age.

Both 401(k) and IRA accounts offer a tax break on the front end. Provided you meet the income obligations, you can put $6,000 into a traditional IRA each year and write off the amount on your annual tax return. With a 401(k) account, you can put away up to $19,500 tax-free each year (and that’s not including the employer match).

You’ll pay taxes on these funds when you withdraw the money in retirement. Or you could use a Roth IRA, which creates a tax break on the back end and allows investments to grow free from taxation once inside the account. And we haven’t even begun to discuss 529 Plans or Health Savings Plans (HSAs), which allow Americans to compile even more tax-advantaged savings.

3) Not Taking a 401(k) Employer Match

Do you like free money? Of course, you do, you’re a human being with a pulse. But instances of free money are few and far between; even Social Security requires paying into the system and accepting a tax bill. However, there is one type of cash reward that’s truly free money – a 401(k) match offered by an employer.

Let’s say that your employer is willing to match 3% of your 401(k) contributions each year. If you put the full $19,500 into your account annually, your employer will kick in an additional $585. That’s $585 in no-strings-attached earnings parked right into your tax-advantaged investment account.

You’ll pay taxes on all your 401(k) funds when you begin withdrawing, but a 401(k) match is something that should be taken full advantage of. If you can’t fully fund your 401(k) up to the limit, at least contribute something to get the match. Otherwise, that money goes right back into your boss’s pocket.

4) Taking Social Security Too Early

Social Security benefits can be received as early as age 62, but there’s very little reason to claim right away unless your health is poor or you have no other form of savings. The best way to maximize your Social Security payments is to wait until age 70 to file. That’s because the federal government considers the full retirement age to be 66 or 67 and full benefits aren’t paid if you begin taking Social Security beforehand.

However, if you can use retirement funds from a 401(k) or IRA to fund your lifestyle until age 70, you’ll get more than 100% of the full retirement benefit – 132% of the benefit to be precise. Taking Social Security too early could mean your monthly benefits will fail to keep up with your cost of living. But if you can hold off, the windfall you receive will be worth the wait.

5) Neglecting Tax Planning in Retirement

Saving too little is the biggest fear of those planning for retirement. But once you reach retirement and begin drawing down your nest egg, overpaying the IRS becomes the nightmare inducer. Taxes and inflation are the biggest concerns to those on fixed incomes and while inflation can’t be planned for, taxes absolutely can be. Tax planning isn’t tax avoidance – it’s a 12-month process of carefully tapping different funding sources to lower our tax bills to the smallest possible point.

For example, if you don’t plan for Required Minimum Distributions (RMDs), you may be forced to withdraw more than you need in a given year, bump yourself into a higher tax bracket, and suffer when a portion of your income gets unnecessarily taxed at a higher rate. Taxes are confusing, which is why a reliable fiduciary advisor is often needed to help navigate. You may be able to save and invest properly on your own, but minimizing taxes usually requires the assistance of a professional.

Working with a good advisor will help you stay focused on your savings goals, investments, and the big picture after retirement so you enjoy your golden years.

Ascendant Financial Solutions, Inc. is an independent SEC Registered Investment Advisory firm serving clients in the Flagstaff and Phoenix, Arizona areas. With more than thirty years of experience in the financial industry, we partner with families, business owners, and retirees to ascend to greater financial heights on their journey to financial freedom. No matter how complex your financial goals are, our team will rise to the challenge to help you meet your goal.