Your Personal Chief Financial Officer

You’ve worked incredibly hard to build your wealth so as you look to the future to continue building and sustaining your wealth, we believe that you deserve exemplary customer service from your financial advisory team.

We take great pride in offering to provide you and your family with services that are above and beyond just investment management. Our team is here to help serve as your personal CFO, helping guide you through life’s ups and downs, market condition changes, and any other situation that can be life-changing. You can count on us to be there when you need us.

Complex Financial Needs-Simplified

Let’s face it….investment management today can be very confusing for investors. At Ascendent Financial Solutions, Inc. we believe that our job is to take complex financial situations and make them simple for our clients to understand. We’ll do the heavy lifting for you.

Ascendant Financial Solutions, Inc. helps clients prepare for the future, reach their big goals, and make the best financial decisions for their businesses all while putting their values and aspirations first.

Wealth Management

We help high-net-worth individuals align their wealth management choices with their goals for the future, no matter how complex. We specialize in helping you make sense of your money.

We’ll create a balanced financial portfolio and map out a path to your goals that makes the most sense for you as an individual. As fiduciary advisors, it’s our job to only give you financial advice that is in your best interest. We’ll advise you, not sell to you.

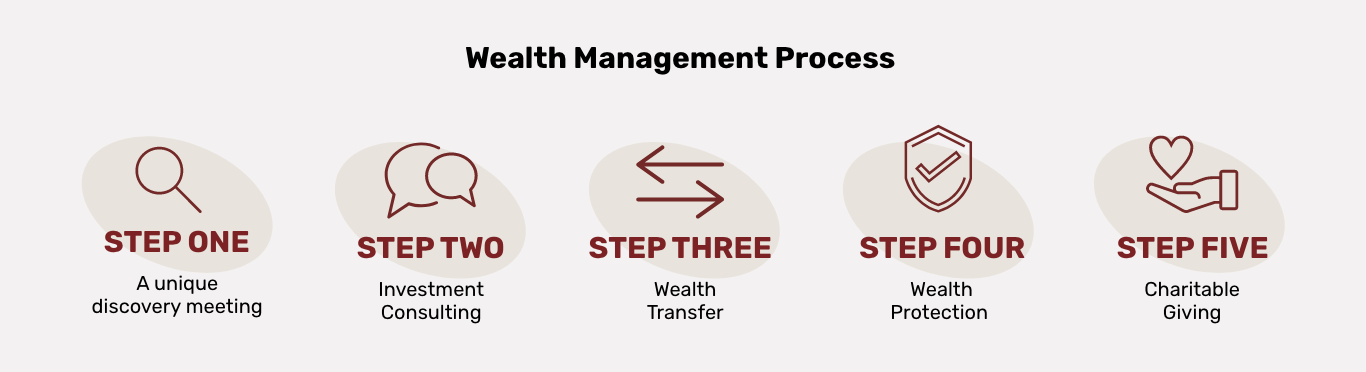

Our clients engage in our comprehensive wealth management approach and are guided through a disciplined five-step process which includes: a unique discovery meeting, investment consulting, wealth transfer, wealth protection, and charitable giving.