What to Expect?

Since the end of 2018, the S&P 500 has gained nearly 93%. This sustained period of outsized returns has many investors waiting for an overdue correction.

While a correction of some sort is inevitable, when it will come is totally unknown. Certainly, the economy is facing a plethora of headwinds, from COVID-19 and worrisome inflation to sky-high valuations and a questionable economic outlook.

Despite these pressures, the market just reached new all-time highs on the first trading day after Christmas. Should we be in the market, expecting a move higher? Should we be moving to the sidelines, getting out ahead of the crash? Should we be rotating from growth to value stocks or vice versa?

Let’s take a look at some of the most important topics on deck for 2022 that will help answer these questions.

2022 Stock Market Outlook

As always, there are multiple narratives playing out simultaneously. Despite COVID and inflation, corporate profits and stock valuations have grown at a breakneck pace, leading to the market setting fresh records as 2021 came to a close.

Though there are plenty of reasons to be skeptical about the future of the national and global economies, stocks have maintained their run of extraordinary performance. The question is: Will it continue?

Want to learn more about market trends and performance? Reach out to one of our financial advisors at Ascendant Financial

COVID Programs and Fiscal Policy

The massive, trillion-dollar stimulus programs created to support the economy during COVID-19 flushed Americans with cash. This cash greatly increased the demand for goods (especially cars and homes), padded savings, and allowed many to make extra contributions to their investment accounts.

The increase in the total amount of dollars invested helped to push stock prices higher.

The extra cash has also placed additional strains on an already struggling supply chain.

Demand has continuously outstripped supply, sending consumer prices higher and higher. Much of this demand remains unsatisfied, though the issues in supply are improving every day.

Additional bills and legislation are also currently in the works. Tax increases for corporations and high-earning individuals seem likely and could lead to decreasing profit margins, meaning lowering spending and investing.

All that said, policymakers have consistently demonstrated their commitment to easy policy and will likely continue their supportive role if needed.

Inflation

As mentioned above, the unprecedented amount of printing by the Federal Reserve led to a greatly increased supply of money. Despite what policymakers want you to think, this has directly led to the inflation we currently see (and will continue to see).

Inflation is the result of too much money chasing too few goods. Inflation is the measure of the rise in aggregate prices. It cannot happen unless the supply of money is increased.

Since February 2020, the supply of money has increased more than 30%. Unless the supply of goods also increases by 30%, the prices of everything must increase.

Let me explain it this way: If the entire economy was made up of $10 and 10 apples, each apple would cost $1. When an additional 30% of the money is added, we now have $13 and only 10 apples, meaning each apple now costs $1.30. That’s inflation.

When the supply chains were damaged, the output of all goods was reduced. So now we have $13 and just 5 apples in the economy, meaning each apple costs $2.60. Eventually, when the supply chain issues are resolved, that “extra inflation” caused by the decrease in output may go away.

But, we will still have a greatly increased supply of money – that isn’t going anywhere, and neither will the accompanying inflation. It’s hard to predict how inflation will pan out in 2022 and beyond, which poses a considerable risk.

Asset Allocation

Where you have your money invested should be determined by your goals. My portfolio should look different than yours, simply because we are trying to go to two different places.

Sure, we can have overlapping investments. But the best portfolio for me will look different than the best portfolio for you. If you don’t know what your ideal asset mix should look like, consider hiring a financial advisor.

Equity Valuations

The forward price-to-earnings (P/E) ratio for the S&P 500 is 21.71x, compared to an average of 16.81x over the last 25 years. Though corporate profits are expanding, a major portion of the market highs can be attributed to these expanding multiples.

Also, with interest rates being held artificially low, demand for stocks remains high. If the Fed is forced to raise rates in 2022 to combat inflation (which is the expectation), some demand may shift back towards bonds.

Rising rates may also reduce corporate profits because of the increase in borrowing costs. It will also dampen consumer borrowing, which should have mixed effects on paper asset prices.

Growth vs Value Stocks

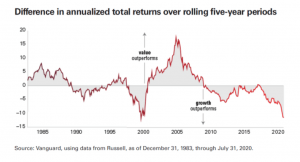

For the last 10 years, growth stocks have consistently outperformed value stocks, despite the historical average tilting in favor of a slight value premium.

Considering current valuations, the value portion of your portfolio may be overdue for a period of outperformance.

The Bottom Line

2022 stock market outlook offers a mixed bag of economic headwinds and tailwinds.

It is nearly impossible to predict the next downturn, and many investors continually miss the 100% run-up trying to avoid the next 20% drop. For almost all, market timing is a myth.

Instead, focus on what you can control. Time in the market is better than timing the market. Have a well-rounded, diversified portfolio that is ready for everything and fits into your broader financial plan. Take a long-term view and expect some volatility along the way.

Returns as high as we’ve enjoyed in the recent past are unlikely to continue, but, based on current prices, investors are expecting positive returns through 2022.